Summitpath Llp Fundamentals Explained

Table of ContentsSummitpath Llp - QuestionsWhat Does Summitpath Llp Do?The Ultimate Guide To Summitpath LlpSummitpath Llp Fundamentals Explained

Most just recently, introduced the CAS 2.0 Practice Advancement Coaching Program. https://issuu.com/summitp4th. The multi-step mentoring program consists of: Pre-coaching alignment Interactive team sessions Roundtable discussions Embellished training Action-oriented mini prepares Companies aiming to broaden right into advising services can also turn to Thomson Reuters Practice Forward. This market-proven methodology supplies web content, devices, and assistance for firms curious about consultatory servicesWhile the changes have actually unlocked a number of development possibilities, they have also caused obstacles and problems that today's companies require to carry their radars. While there's difference from firm-to-firm, there is a string of common challenges and concerns that tend to run market large. These include, yet are not restricted to: To stay affordable in today's ever-changing governing atmosphere, firms have to have the capacity to promptly and successfully perform tax study and enhance tax coverage effectiveness.

Furthermore, the new disclosures may lead to a rise in non-GAAP procedures, historically an issue that is extremely scrutinized by the SEC." Accounting professionals have a lot on their plate from governing modifications, to reimagined company designs, to a rise in client assumptions. Equaling everything can be difficult, but it doesn't have to be.

Rumored Buzz on Summitpath Llp

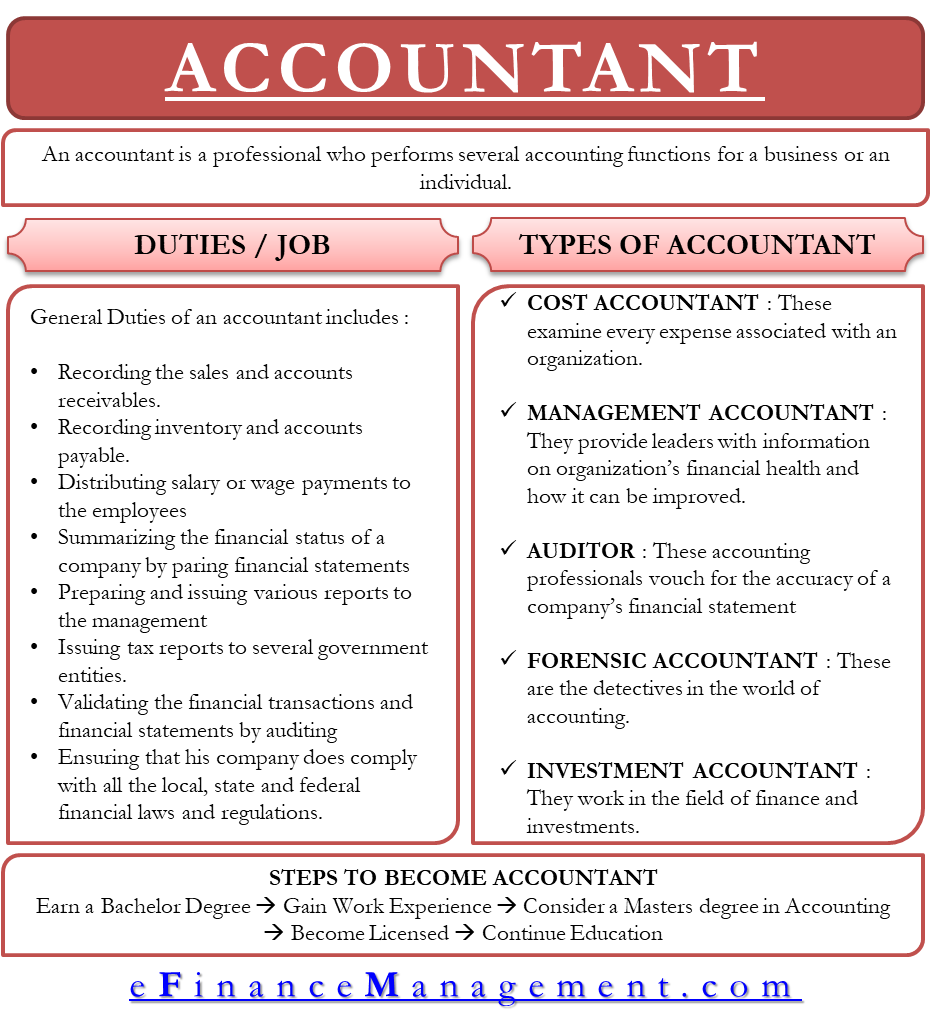

Below, we explain four CPA specializeds: taxation, monitoring accountancy, monetary coverage, and forensic accountancy. Certified public accountants focusing on tax help their clients prepare and submit tax obligation returns, minimize their tax concern, and stay clear of making mistakes that might cause pricey penalties. All CPAs need some expertise of tax legislation, yet specializing in tax implies this will certainly be the focus of your job.

Forensic accountants generally start as general accounting professionals and move into forensic accountancy roles in time. They require solid analytical, investigative, service, and technical bookkeeping abilities. Certified public accountants that focus on forensic bookkeeping can in some cases go up right into administration bookkeeping. CPAs need at the very least a bachelor's level in accounting or a similar area, and they should complete 150 credit score hours, including accountancy and business courses.

No states call for a graduate degree in accounting., bookkeeping, and taxation.

And I liked that there are great deals of different job options and that I would not be out of work after graduation. Accounting additionally makes practical feeling to me; it's not just theoretical. I such as that the debits constantly need to equate to the credit scores, and the balance sheet needs to stabilize. The certified public accountant is an essential credential to me, and I still get continuing education debts annually to stay on par with our state requirements.

Some Known Facts About Summitpath Llp.

As a freelance professional, I still make use of all the standard structure blocks of bookkeeping that I discovered in college, pursuing my CPA, and working in public bookkeeping. Among the important things I truly like regarding accounting is that there are various work readily available. I chose that I intended to start my job in public bookkeeping in order to discover a lot in a brief amount of time and be exposed to various sorts of clients and click this different locations of audit.

"There are some work environments that do not wish to consider somebody for an audit duty that is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a very beneficial credential, and I wished to place myself well in the industry for numerous jobs - Calgary Accountant. I chose in college as a bookkeeping major that I wished to attempt to obtain my certified public accountant as quickly as I could

I have actually fulfilled lots of fantastic accounting professionals that don't have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential really assists to market your proficiency and makes a distinction in your compensation and occupation alternatives. There are some work environments that do not wish to take into consideration somebody for a bookkeeping duty who is not a CPA.

Some Known Facts About Summitpath Llp.

I actually appreciated working with different kinds of projects with various customers. I found out a lot from each of my colleagues and clients. I collaborated with several various not-for-profit companies and located that I have an enthusiasm for mission-driven companies. In 2021, I determined to take the next action in my audit occupation journey, and I am now an independent bookkeeping professional and business consultant.

It remains to be a growth location for me. One essential high quality in being an effective certified public accountant is genuinely caring about your clients and their businesses. I love collaborating with not-for-profit customers for that really reason I feel like I'm truly contributing to their objective by assisting them have great economic information on which to make smart organization choices.